How Do Onroad And Door-to-Door Sales IT Systems Evolve after the Electronic Receipt Arrival?

Few months away from the electronic invoicing launch, we are moving closer to the introduction of the electronic receipt to complete the fiscal certification process: according to the 2019 Fiscal Act, in fact, from July 1st daily payment data telematic transmission to the Income Revenue will be mandatory for goods and services regarding VAT purposes.

The obligation is initially directed to every taxpayer with a turnover over 400,000€ (except some categories already exempted from fiscal receipt issuing), but will be extended to every VAT number holder from January 1st 2020.

This new modality is not just applied to minute retailers, hotels, restaurants, etc., but also to those operating onroad sales with private customers, as is often the case in the coffee sector, and to those managing door-to-door sales to final consumers who must therefore issue a fiscal receipt to a private citizen.

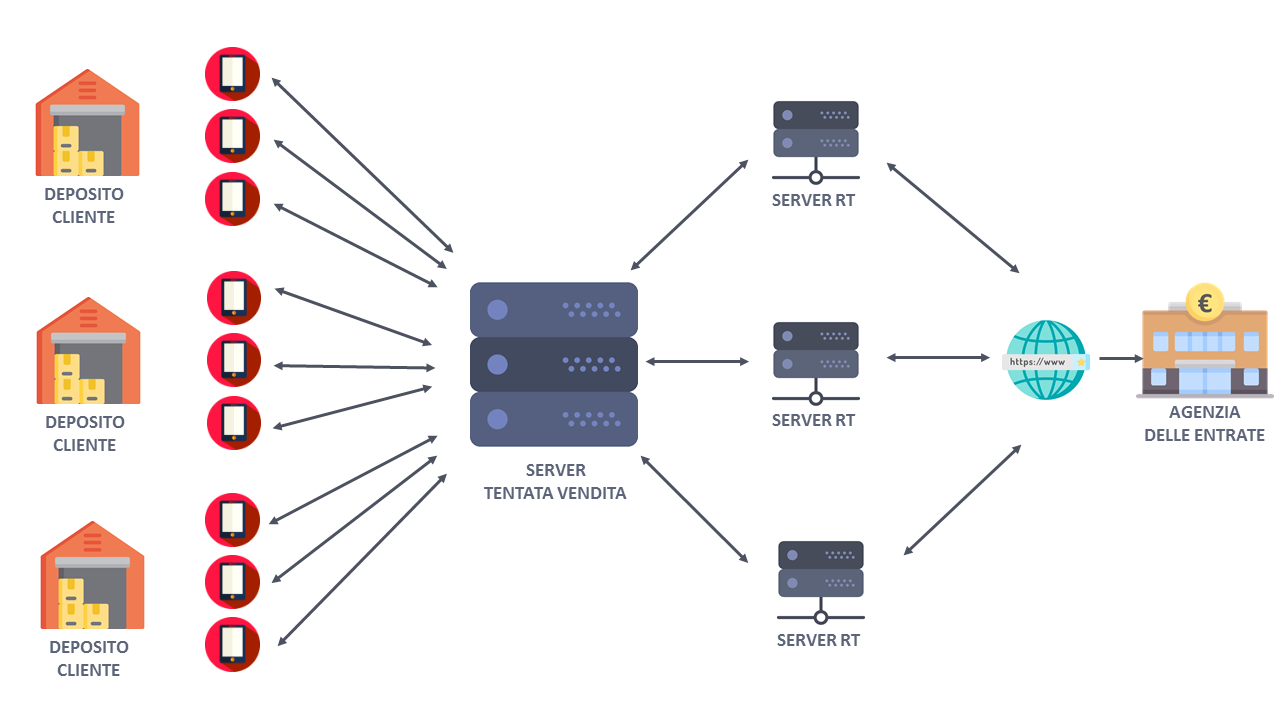

One of the solutions proposed considers onroad sales IT systems integration with the “RT Server”, a special version of the “Telematic Cash Register”, contemplated by the technical specifications edited by the Income Revenue Authority, born to meet the exigencies of Mass Market Retailers or, in general, subjects telematically transmitting payment data to the Income Revenue and featuring cashpoints defined as “non fiscal” or “tax exempt”.

In the case of onroad sales, we can therefore compare the deposit to the point of sale and the mobile device in use to the cashdesk: in every deposit an RT Server is installed, interfacing with the onroad sales system and transmitting to the Income Revenue Agency receipts issued by operators to private customers.

The commercial document issued to the customer is created in the onroad sales system itself according to the specifications published by the Income Revenue contemplating, for example, item grouping by VAT tax rate, parameter indications such as issuing cashdesk, reference RT server, … payment mode (cash, electronic payment), amount paid, change given, …

Are you interested in further details? Contact us.