SoftPOS: shaping the future of B2B payments

May is Netcomm Forum time, one of the largest Italian events dedicated to e-commerce and digital transformation: this year’s agenda also features a series of events focused on Payment & Fintech.

Just looking at the list of sponsors is enough to realise how digital payments are becoming ever more prominent: a field in which innovation never stops.

Every year new services emerge, all designed to make the payment experience as simple as possible, both for the payer and for the payee.

This sector is also constantly growing: the Innovative Payments Observatory of the School of Management at the Politecnico di Milano reports that in Italy, card transactions grew by +33.6% in 2022, reaching a turnover that almost touched €400 billion (equivalent to 40% of consumption).

Beyond transaction volumes, the way we pay is changing: in-store payments made via smartphones and wearable devices grew by +119% compared to the previous year.

We can also observe how the tools we use daily as consumers in the B2C market are, as a natural consequence, being transferred and adopted in the B2B space.

The innovation I am referring to is not limited to the physical means of payment, but also — and above all — to the services.

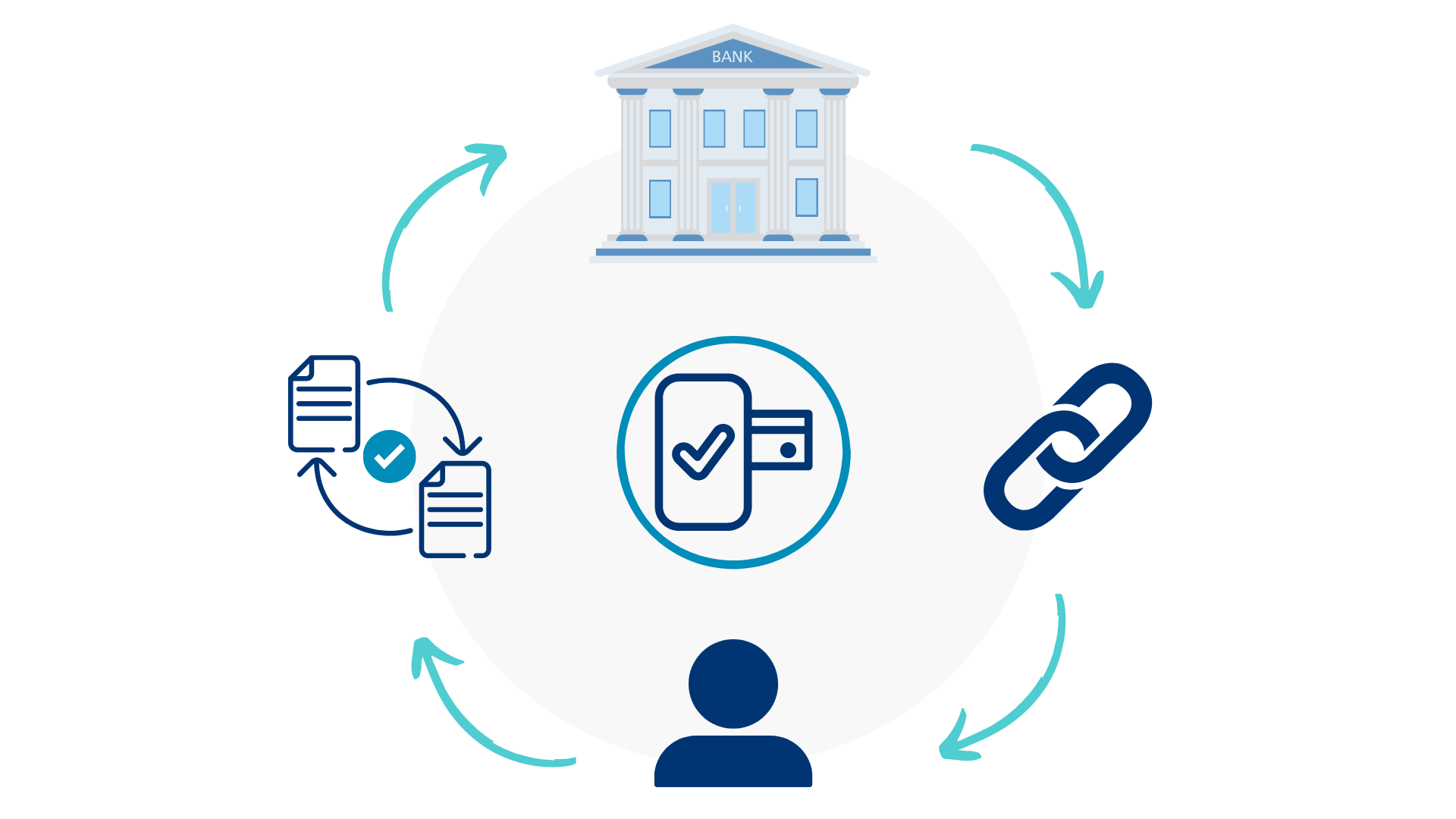

Among the many introduced in recent years, here are a couple particularly useful in the B2B space: “pay-by-bank” and “pay-by-link” services.

With the first, payment platforms aim to make it easy for the user to pay directly via their bank account, without needing to search for the supplier’s IBAN to make a transfer, but simply by authorising the payment, which already contains the necessary data to identify what the user is paying for.

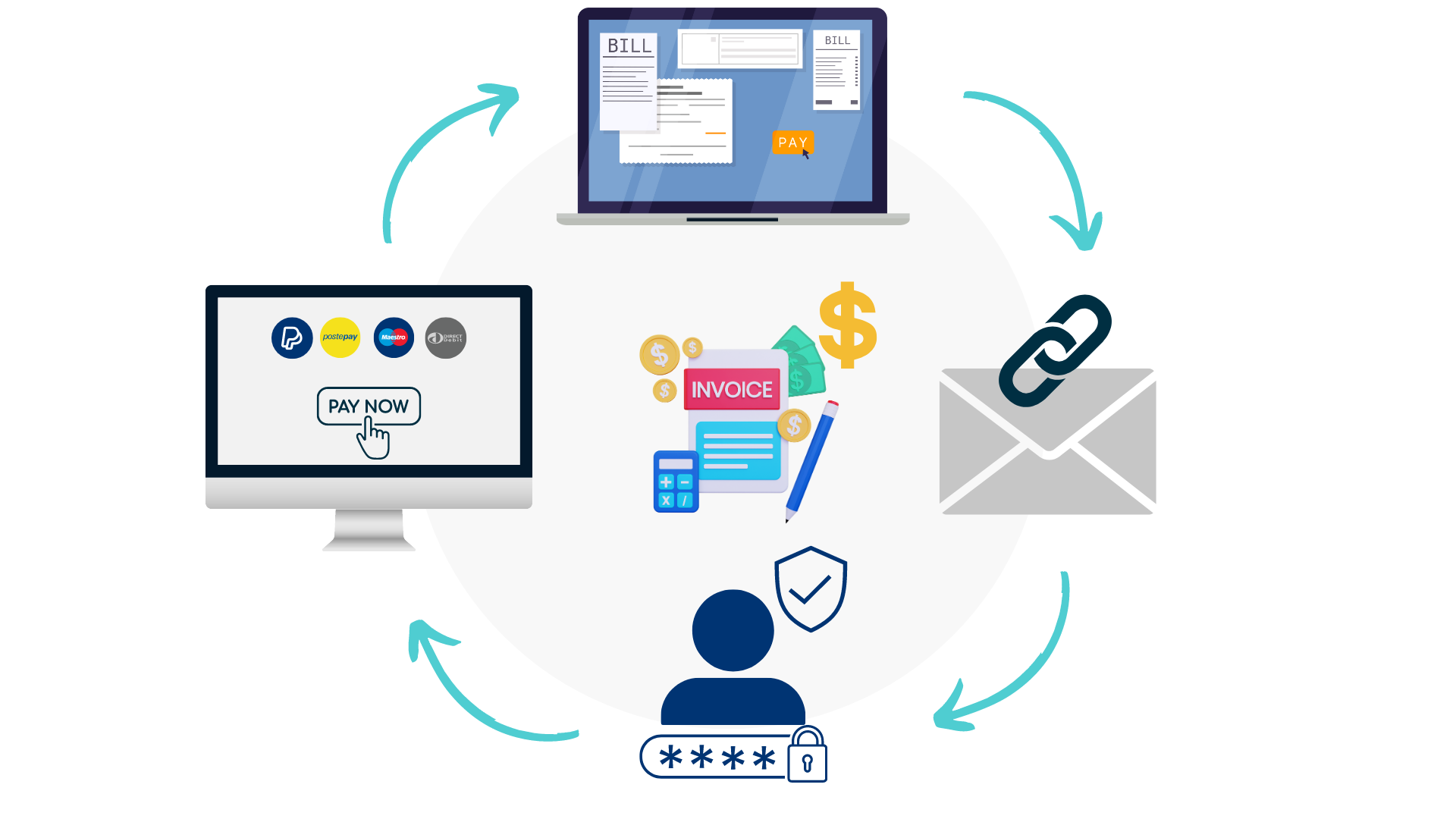

The pay-by-link service is also designed with user simplicity in mind.

Here’s how it works: the party requesting the payment logs into a portal, enters the amount and the document reference, and the system generates a link that can be sent to the debtor, even by e-mail. By clicking on the link, the debtor can pay using any method available online: it is enough to select the payment option, authenticate if required, and confirm.

This is particularly useful in the B2B context, for example when chasing payment of an invoice, as an alternative to cheques, or to avoid having to wait until the end of the month to receive a payment.

What makes these systems particularly interesting is their integration with existing software: this way, the user experience can be made even smoother.

You might say, “Sure, we all know online services can be integrated easily, but what if the user wants to pay by card?” This is where the concept of SoftPOS comes into play!

Contactless cards, also thanks to the acceleration brought about by the pandemic in recent years, are becoming increasingly widespread: last year, contactless payments reached €186 billion, up +45% compared to 2021.

This trend, combined with the widespread use of smartphones, is enabling the creation of new services.

Modern smartphones are equipped with NFC readers/transmitters and can already function as a card through digital wallets.

But that’s not all: their ability to read NFC tags also allows them to read contactless cards, which use the same technology.

By leveraging these capabilities, SoftPOS was born: simply download the app provided by the payment service provider onto your device, and your smartphone is instantly transformed into a POS terminal.

The advantages compared to a traditional POS reader are significant:

Aton’s .onSales suite applications make it possible to manage order collection (for payments collected in the field by sales representatives), b2b e-commerce (allowing business customers to pay invoices directly via the app) and van selling (for mobile sales operators). These are already integrated with certain payment apps, meaning the entire sales cycle can be completed using the same device.

For example, those who will benefit most from these new opportunities include all “nomadic” sales categories who, like many of our clients, operate through van selling and need to collect payments directly from customers.

This allows the salesperson to link documents with the payment, enabling accurate reporting and savings in the reconciliation phase, while also allowing the customer to settle their balance in order to place new orders — for instance, when their account is blocked due to exceeded credit limits.

As I write, the Netcomm Forum is taking place: we will see whether it brings further developments in this constantly evolving field!

We invite you to follow us to stay up to date on the evolution of digital payments: we are already supporting some of our clients in adopting these new methods and solutions, which are proving highly valuable for their businesses.